The decision to legalize sports betting has made the Grand Canyon State an exciting destination for betting enthusiasts. Arizona has welcomed numerous sports betting platforms. If you want to find out about the best of them, we've reviewed them right here.

The variety of sports that you can wager on is vast, extending from football and basketball to baseball, horse racing, and hockey. Top Arizona sports betting sites also offer various features like live betting, mobile betting, and in-play betting. So, whatever your preferences, there's likely an AZ sportsbook out there for you.

As Arizona sports betting continues to thrive, more residents are becoming interested in exploring the available options. With an increasing number of online sportsbooks like DraftKings, Caesars, BetRivers, FanDuel, and Betfred the sports betting landscape in Arizona is evolving.

With all this change, we aim to make it easy to keep on top of it all.

Best Legal Arizona Sportsbooks in 2024

| Name | Score | Play Now | Welcome Bonus | Payment Methods | Sports | Payout Speed | Disclaimer | |

|---|---|---|---|---|---|---|---|---|

| 9.8 | Claim OfferBetMGM.com | Bet $5 Get $158 in Bonus Bets | Cash, Venmo, PayPal, Bank Transfer, Apple Pay, Play+ | 20+ | 3-8 Days | Gambling problem? Call or TEXT 1-800-GAMBLER. Must be 21+ and present in the state you're wagering in. T&C Apply. | |

| 8.8 | Claim OfferCaesars.com | Get Your First Bet Back If It Loses - up to $1,000 | Cash, Venmo, PayPal, PayNearMe, Play+, ACH Transfer, Visa, Mastercard | Hours - 5 Days | Must be 21 or older to gamble. Know When To Stop Before You Start.® Gambling Problem? If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER (1-800-426-2537). | ||

| 9.4 | Claim OfferDraftKings.com | Bet $5 Get $150 in Bonus Bets Instantly! | Cash, Venmo, PayPal, Apple Pay, Play+, ACH Transfer, Visa, Mastercard | 25+ | Hours - 5 Days | Gambling problem? Call or TEXT 1-800-GAMBLER. Must be 21+ and present in CO. T&C Apply. | |

| 9.5 | Claim OfferBetRivers.com | Get up to a $250 Second Chance Bet | Venmo, PayPal, PayNearMe, Play+, ACH Transfer, Visa, Mastercard | 25+ | 1-6 Days | Gambling problem? Call or TEXT 1-800-GAMBLER. Must be 21+ and present in CO. T&C Apply. | |

| 9.6 | Claim OfferFanDuel.com | Bet $5 Get $200 In Bonus Bets If Your Bet Wins | Cash, Venmo, PayPal, Apple Pay, ACH Transfer, Visa, Mastercard | 18+ | Hours - 5 Days | Gambling Problem? Call 1-800-GAMBLER. Hope is here. Gamblinghelplinema.org or call (800)-327-5050 for 24/7 support (MA). Call 1-877-8HOPE-NY or Text HOPENY (467369) (NY). | |

| 9.0 | Claim OfferUnibet.com | Get a 2nd Chance Bet Up To $250 | PayPal, Debit Card, Trustly, PayNearMe, Play+, ACH Transfer | 20+ | 3-10 Days | Gambling Problem? Call 1-800-GAMBLER. Must be 21+ and present in PA. T&C Apply. |

Arizona Sports Betting Overview

Here's a quick rundown of the most important facts about sports betting in Arizona.

What is the legal betting age at Arizona sportsbooks? | 21 years old |

|---|---|

Do you need to be in Arizona to place bets? | Yes |

When did sports betting launch in Arizona? | April 2021 |

Is sports betting legal in Arizona? | Yes |

Is gambling legal in Arizona? | Sports yes/ Casino no |

Is online poker legal in Arizona? | No |

How many sports betting apps are in Arizona? | 25 |

Who controls sports betting in Arizona? | Arizona Department of Gaming |

Can you bet on in-state Arizona college teams? | Yes |

What is the tax rate on winnings in Arizona? | 2.59% - 4.5% |

Key Takeaways

Bettors can legally place wagers both in-person and online in Arizona

The tax rate on winnings (2.59%-4.5%) is comparatively low in Arizona

Bettors in Arizona can take advantage of bonuses and promotions

Is Sports Betting Legal in Arizona?

Sports betting is legal in Arizona. The Arizona Department of Gaming legalized sports gambling in 2021. There are now 25 legal sports betting platforms serving this state. It is also legal to bet in person in Arizona.

Casino gaming is a little different. It is still illegal to play casino games online for real money in Arizona. However, if you want to play casino games for real money then you can visit a land-based casino.

5 Best Sports Betting Sites in Arizona Reviewed

Arizona has a flourishing sports betting scene, with numerous online sportsbooks available for bettors. We have reviewed the top 5 Arizona sports betting sites, helping you find the perfect platform to place your bets.

Best Arizona Betting Site for In Play Betting: BetMGM

Best Arizona Betting Site for VIPs: Caesars

Best Arizona Betting Site for Bonus Bets: DraftKings

Best Arizona Betting Site for Competitive Odds: BetRivers

Best Arizona Betting Site for Fast Payouts: FanDuel

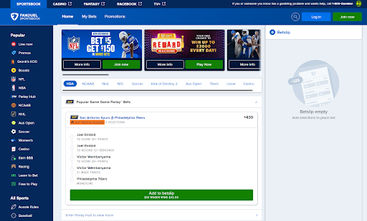

BetMGM - Best Arizona Betting Site for In Play Betting

BetMGM is licensed to offer its sports betting services in Arizona, and bettors have access to major North American leagues and collegiate sports. Residents of Arizona can download the reliable BetMGM app, a handy tool for in-play betting on over 20 sports, and depositing funds through secure payment methods.

BetMGM is not short-changing Arizona players in the bonus department, providing competitive promotions such as a tempting $1,000 in Bonus Bets, packed as a welcome deal.

BetMGM Overview

Welcome Bonus | Up to $1,000 bonus back for your first bet |

|---|---|

Licences | Colorado Department of Revenue, Arizona Department of Gaming, Illinois Gaming Board, Indiana Gaming Commission, Iowa Racing and Gaming Commission, Kansas Racing and Gaming Commission, Louisiana Gaming Control Board, Maryland State Lottery & Gaming Control Agency, Michigan Gaming Control Board, Nevada Gaming Commission, New Jersey Division of Gaming, New York State Gaming Commission, Ohio Lottery, Pennsylvania Gaming Control Board, Tennessee Sports Wagering Advisory Council, Virginia Lottery, West Virginia Lottery, Wyoming Gaming Commission |

Sports | Soccer, Basketball, Baseball, Football, Boxing, Tennis, Motor Sports, Golf, Rugby, Hockey, Darts, MMA |

Payment Methods | Visa, Mastercard, Discover, PayPal, Skrill, Play+, PayNearMe, ACH/VIP Preferred e-check, Bank Transfer, Apple Pay, Gift Cards |

Mobile App | Android & iOS |

Year Founded | 2018 |

What We Like & Dislike About BetMGM

- Established US sportsbook

- Live streaming of sports events

- Player-friendly wagering requirements

- Renowned banking methods

- Outdated design of the desktop version

- Long payouts procedures

Caesars - Best Arizona Betting Site for VIPs

Caesars Sportsbook inspires confidence in Arizona bettors by partnering with popular leagues and celebrities. However, the ultimate seal of approval stems from the gambling license issued by the proper authorities in Arizona, ensuring a safe online gambling experience.

Players from Arizona can start betting on their preferred sports with a boost from the operator, packed as a 100% match up to $1,250 as Bet Credit. The bonus bets are eligible for wagering on 20 sports and hundreds of domestic and international competitions.

Caesars Overview

Welcome Bonus | 100% bonus match up to $1,250 if you lose your first bet of $10 or more |

|---|---|

Licences | Colorado Division of Gaming, Arizona Department of Gaming, Illinois Gaming Board, Indiana Gaming Commission, Iowa Racing and Gaming Commission, Kansas Racing and Gaming Commission, Louisiana Gaming Control Board, Maryland State Lottery & Gaming Control Agency, Michigan Gaming Control Board, Mississippi Gaming Commission, Nevada Gaming Commission, New Jersey Division of Gaming Enforcement, New York State Gaming Commission, Ohio Lottery, Pennsylvania Gaming Control Board, West Virginia Lottery, Virginia Lottery, Wyoming Gaming Commission |

Sports | Football, Basketball, Hockey, Golf, Soccer, Tennis, Motor Sports, Boxing, MMA, Horse Racing, Cricket, etc. |

Payment Methods | Visa, Mastercard, Discover, PayNearMe, PayPal, ACH e-check, Play+, Skrill, Wire Transfer, Online Banking, Caesars Prepaid Card |

Mobile App | Android & iOS |

Year Founded | 2021 |

What We Like & Dislike About Caesars

- Live streaming of sports matches

- Micro-betting options

- SGP bonuses

- Multi-tier VIP club

- A limited selection of niche sports

- Cumbersome design

DraftKings - Best Arizona Betting Site for Bonus Bets

DraftKings is licensed to operate in Arizona and is the official partner of the NFL, NHL, NBA, PGA Tour, and UFC. In total, 24 different sports are on the menu in Arizona, with hundreds of leagues. Aside from traditional sports, DraftKings also offers DFS betting in Arizona.

Registered members receive a free sportsbook app. Plus, loyalty gets rewarded with access to the Dynasty VIP Club, where exclusive bonuses and invites to special events await bettors from Arizona.

DraftKings Overview

Welcome Bonus | Up to $150 in bonus bets after making your first $5 bet |

|---|---|

Licences | New Jersey Division of Gaming, Colorado Department of Revenue, Arizona Department of Gaming, Illinois Gaming Board, Indiana Gaming Commission, Iowa Racing and Gaming Commission, Kansas Racing and Gaming Commission, Louisiana Gaming Control Board, Maryland State Lottery & Gaming Control Agency, Michigan Gaming Control Board, Nevada Gaming Commission, New York State Gaming Commission, Ohio Lottery, Oregon Lottery, Pennsylvania Gaming Control Board, West Virginia Lottery, Virginia Lottery, Wyoming Gaming Commission |

Sports | Football, Baseball, Basketball, Soccer, Boxing, Tennis, MMA, Golf, Hockey, Cricket, Motor Sports, Darts, Snooker, Skateboarding, Volleyball, Cycling, Handball, Lacrosse |

Payment Methods | Visa, Mastercard, PayPal, Venmo, VIP Preferred, Wire Transfer, DraftKings gift card |

Mobile App | Android & iOS |

Year Founded | 2012 |

What We Like & Dislike About DraftKings

- First deposit match-up bonus of up to $1,000

- No fees on withdrawals or deposits

- Latest SSL encryption

- Reliable payment providers

- A payout can take up to 5 days

- Customer support needs improvement

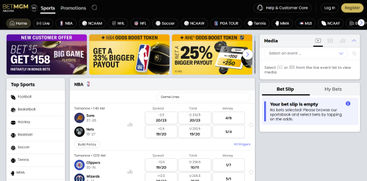

BetRivers - Best Arizona Betting Site for Competitive Odds

BetRivers is a trusted sportsbook in Arizona, providing a substantial portfolio of sports betting markets. Arizona bettors can wager on over 25 sports, with the NFL, NBA, MLB, NCAA, and HNL receiving preferential coverage. The odds are, without a doubt, some of the best on the market, especially among rivaling sportsbook operators in Arizona. The same applies to its competitive bonus offer. BetRivers’ trump card is the 100% match up to $500 as a Second Chance Free Bet.

BetRivers Overview

Welcome Bonus | Up to $500 in free bets |

|---|---|

Licences | Colorado Division of Gaming, Arizona Department of Gaming, Illinois Gaming Board, Indiana Gaming Commission, Iowa Racing and Gaming Commission, Louisiana Gaming Control Board, Maryland State Lottery & Gaming Control Agency, Michigan Gaming Control Board, New Jersey Division of Gaming Enforcement, New York State Gaming Commission, Ohio Lottery, Pennsylvania Gaming Control Board, West Virginia Lottery, and Virginia Lottery |

Sports | Football, Basketball, Hockey, Golf, Soccer, Tennis, Motor Sports, Boxing, MMA, Horse Racing, Cricket, etc. |

Payment Methods | Venmo, PayPal, PayNearMe, Play+, ACH Transfer, Visa, Mastercard |

Mobile App | Android & iOS |

Year Founded | 2019 |

What We Like & Dislike About BetRivers

- Wide range of betting markets

- In-play bets

- Same-game parlays

- Streamlined app

- A limited selection of payment methods

- Live chat agents do not connect immediately

FanDuel - Best Arizona Betting Site for Fast Payouts

FanDuel makes Arizona one of its bases in an ever-expanding network of sportsbooks. Residents of Arizona can legally open an account and wager on any of the over 20 traditional sports betting markets or indulge in daily sports fantasy betting, a FanDuel specialty.

This signup offer is consistent across all US states, and bettors in Arizona can snag a Risk-Free bet of up to $1,000. The minimum qualifying wager is $10. FanDuel is one of the most reliable Arizona sportsbooks for fast payouts. It completes most withdrawals in under 24 hours.

FanDuel Overview

Welcome Bonus | Up to $1,000 risk free bet |

|---|---|

Licences | Colorado Department of Revenue, Arizona Department of Gaming, Illinois Gaming Board, Indiana Gaming Commission, Iowa Racing and Gaming Commission, Kansas Racing and Gaming Commission, Louisiana Gaming Control Board, Maryland State Lottery & Gaming Control Agency, Michigan Gaming Control Board, New Jersey Division of Gaming Enforcement, New York State Gaming Commission, Ohio Lottery, Pennsylvania Gaming Control Board, Tennessee Sports Wagering Advisory Council, Virginia Lottery, West Virginia Lottery, Wyoming Gaming Commission |

Sports | Football, Basketball, Boxing, Baseball, MMA, Soccer, Tennis, Golf, Motor Sports, Hockey, Cricket, Cycling, Snooker, Handball |

Payment Methods | Visa, Mastercard, PayPal, Apple Pay, Venmo, ACH check, PayNearMe |

Mobile App | Android & iOS |

Year Founded | 2009 |

What We Like & Dislike About FanDuel

- Plenty of secondary sports markets

- Generous welcome bonus

- Boosted odds available

- Responsive mobile apps

- Lack of a rewards program

- Live chat response is slow

With a variety of sports betting options in Arizona, each platform offers unique features and promotions catering to different preferences. Before committing to a sportsbook, be sure to explore their offerings and find the best fit for your betting style.

How We Rate Arizona Sports Betting Sites & Apps

In order to bring you the best betting apps in your state, it's important to have stringent criteria to evaluate them on. Below are the most important criteria we use to decide which online sports betting sites make the cut.

Licence and Legality: It goes without saying that we only recommend legal sports betting sites. This means that they have the correct licences to operate in Arizona.

Banking and Payout Speed: It’s essential that Arizona sports betting platforms have a choice of payment providers. We look for credit and debit cards, e-wallets, and bank transfers. We also look for fast payouts, ideally within 48 hours.

Security, Safety & Customer Support: A licence is enough to determine that a site is safe. However, we also look for SSL encryption and customer reviews. This helps us to find the sportsbooks that really stand out.

Range of Sports: We require all online sportsbooks to cover popular leagues like the NBA, MLB, and NHL, as well as lesser-known sports and international events. This ensures that you have access to a wide array of betting options, from major games to niche events.

Bonuses and Promotions: We look for a great welcome bonus, with the addition of regular promos for existing customers. We also check the terms of each bonus to make sure they are fair, as well as good value.

Odds: Competitive odds are so important. We compare odds across sportsbooks to make sure you're getting good value on every bet.

What's Happening in Arizona? Sports Betting News & Updates

Arizona holds dozens of sporting events each year and many occur in Phoenix. This city is one of only 13 in the United States to have representatives in all four major professional sports leagues - football, basketball, baseball, and hockey. These professional sports teams include:

The Arizona Diamondbacks, an MLB team who can be seen playing at the Chase Stadium.

The Arizona Coyotes, an NHL team who can be seen playing at the Mullett Arena.

The Phoenix Suns, an NBA team who can be seen playing at the Suns Arena.

The Arizona Cardinals, an NFL team who can be seen playing at the State Farm Stadium.

Of course, these four teams make up a lot of the biggest sporting events taking place in Arizona, but by no means all of them. Below we'll take a brief look at some of the most exciting sporting events happening in Arizona this year.

The Fiesta Bowl, January 2024

American College Football is always a treat to watch. It's fast, furious and a chance to see the big stars of tomorrow. The Fiesta Bowl has been held in Arizona since 1971 and has seen some incredible showdowns in its time. The last time Arizona took the title was in 1994, so we're crossing our fingers for them to reclaim their crown this year.

Every three years, it's this event that decided which one of the NCAAF teams will play for the championship - but that doesn't mean the intervening years are any less exciting. Make sure you get your tickets for the State Farm Stadium event well in advance. Plus, check out the parade that goes on beforehand, featuring teams from the Fiesta Bowl and the Cactus Bowl.

The Waste Management Phoenix Open, February 2024

Arizona is famous the world over for its golfing facilities and 'The People's Open' is one of the most famous golf tournaments in the state. Taking place in February, at the Tournament Players Club in Scottsdale, this week-long event brings the best golfers in the world to Phoenix. Here, they compete as part of the PGA tour for a prize pool of more than $8 million. Expect to see huge names like Webb Simpson, Bubba Watson and Rickie Fowler amongst the competitors.

The Cactus League, March & April 2024

There are few chances to see such brilliant baseball up close, but each Spring the Cactus League Spring Training comes to Phoenix. It's here that 15 teams (from both the National League and the American League) face off in Phoenix's stadiums. The great thing about this is how much smaller the stadiums are that they play in. This means you can really be up close to the action from some of the best teams in the sport today.

You'll get to see up and coming stars before they hit the big time, as well as some bonafide legends from the major leagues just getting in some training. It's a real treat, but one of Phoenix's worst-kept secrets, so snag a ticket early.

NASCAR Championship Weekend, November 2024

Arizona loves NASCAR, so much that Phoenix Raceway holds two race weekends every year. We're particularly interested in the NASCAR Championship Weekend, the culmination of the whole season. The NASCAR Cup Series Championship Race takes place in November and promises to be an exhilarating time. It is essential to book tickets well in advance to avoid disappointment, as this is always a sell out event.

If you fancy getting double the NASCAR action then check out the Shriner's Children's 500. This is another huge race held at Phoenix Raceway, but much earlier in the year in March.

Latest Arizona Sports Betting News

Want to find out more about betting on some of the events shown above? Or some events where Arizona's major league teams are playing? Check out our advice below.

Yes! All of Arizona's best online sportsbooks offer betting on all of the sports mentioned above. As long as you are over the age of 21 and currently in the state of Arizona, you will be able to bet on all of the games mentioned.

Best Sports Promo Codes & Bonuses in Arizona

There are loads of different promotions that you can make the most of for betting in Arizona. But remember, you can only use sportsbook bonuses, not casino ones. Below are some of the different types of bonus that you can expect to find in Arizona.

Tip: Looking for the most recent promo codes? Check out our regularly updated guided to Arizona sports betting promo codes.

Bonus Bet

Also known as a risk free bet, bet tokens, or a free bet. A bonus bet is simply a bet that you can place (usually) on any sport. Your stake is paid for by the sportsbook as a gift to you.

First Bet Insurance

Also known as a first bet safety net, or a second chance bet. This bonus allows you to have your stake refunded if you place a bet and it loses. It's usually offered on your first bet with a new sportsbook.

Parlay Insurance

This kind of bonus offer allows you to 'insure' certain legs of a parlay, or same-game parlay. This means that if one leg fails, your parlay is still paid out but at a lower rate.

Deposit Match Bonus

Also called a match bonus, matched bonus, or bonus cash. The deposit match bonus sees the sportsbook match your initial deposit, giving you (usually) twice as much money to bet with. Most deposit match bonuses are a 100% match, some are more, others less.

No Deposit Bonus

A no deposit bonus is where the sportsbook gives you a bonus simply for signing up. You don't need to make a deposit in order to be eligible. It could take the form of a bonus bet, or free cash.

Boosted Odds

Boosted odds, or odds boosts tend to be given to existing customers. They increase the odds on big sporting events, leading to higher payouts.

Below are some of the best sportsbook offers available to Arizona bettors right now.

Sportsbook | Promotions |

|---|---|

BetRivers | Risk free bet up to $250 |

DraftKings | Bet $5 get $150 in bonus bets |

BetMGM | $1,500 back in bonus bets if your first bet loses |

These are just a handful of the best sign-up bonuses for Arizona betting sites in April, 2024. These bonuses can change at short notice, but were correct at the time of writing. For even more bonuses, check out our guide to sports betting promo codes.

Sports Betting Bonus Terms and Conditions

Before you claim any bonus, it's important to be aware of any terms and conditions that come along with it. Below are some of the most common terms that you'll find relating to the sports bonuses we discussed above.

Wagering Requirements

Often bonuses are subject to wagering requirements. These are how many times you need to wager the bonus amount before you can withdraw winnings. Usually, sports promos in Arizona have 1x wagering requirements, meaning you wager the bet once and can withdraw your winnings. Look out for higher wagering requirements as they can be difficult to complete.

Minimum Odds

This refers to the minimum price a bet needs to be to qualify for the bonus. Rarely will you be able to bet on the short priced favorite with a bonus bet.

Maximum Win

This is the absolute maximum amount you can win when using a promo or bonus. Look for high maximum win caps in the bonus terms.

Expiry Date

Most bonuses have an expiry date, after which they are void. Long expiry dates give you plenty of time to find the right bet to place. If your bonus has wagering requirements attached then you must complete these before the expiry date.

Are There Free AZ Sports Betting Platforms?

There are no sportsbooks that operate on an entirely free basis, but there are lots of online sports betting platforms that offer free bets. These allow you to enjoy betting for free and even give you a chance to win real money. Below are some of those free sports betting sites that we recommend:

DraftKings Sportsbook is a popular choice among bettors in Arizona. They offer an all-in-one platform for sports betting, DFS, and NFT games. They feature a wide selection of markets, including in-play betting and various proposition wagers. New users can often find promotions such as deposit match bonuses when signing up for DraftKings Sportsbook.

FanDuel Sportsbook is another top option for Arizona bettors. They frequently provide promotional offers for new users, giving you the opportunity to claim free bets or deposit match bonuses upon registration. By taking advantage of these offers, you can increase your chances of success without using your own money.

BetMGM Arizona is a well-established sportsbook offering competitive promotions, including their “No Sweat First Bet” offer. With this promotion, if your first bet loses, you are reimbursed with a free bet up to a certain amount. This allows you to try out the platform and make your first wager without worry.

Here are some examples of the promotions you might find at these sportsbooks:

Sportsbook | Promotion Type | Details |

|---|---|---|

DraftKings | Deposit Match | Matched bonus on initial deposit |

FanDuel | Free Bet | Free bet upon registration |

BetMGM Arizona | No Sweat First Bet | Reimbursed free bet if the first wager loses |

Land Based Sportsbooks in Arizona

All of the sportsbooks that we have recommended are legal in Arizona. However, not all of them have a land-based kiosk. These sportsbooks all have physical locations in the state. So, if you'd rather bet in person, you can do it here.

Want to know more about Arizona's thriving sports betting scene? Here's more info on the various land-based sportsbooks offering a range of betting options. Among the top land-based sportsbooks in Arizona, you can find options at tribal casinos, the Arizona Diamondbacks facility, and TPC Scottsdale.

Sportsbook | Location | Highlights |

|---|---|---|

Hard Rock Sportsbook | Tribal Casino | Extensive betting options, partnerships with Betway |

TPC Scottsdale Sportsbook | TPC Scottsdale | Golf-focused betting, exclusive events coverage, in association with DraftKings |

Arizona Diamondbacks Sportsbook | Chase Field | Baseball-focused betting, live game coverage, partnership with Caesars Sportsbook |

FanDuel Sportsbook | Footprint Center | 7,000 square feet to watch sports in Phoenix, partnership with FanDuel |

BetMGM Sportsbook | State Farm Stadium | Self service betting kiosks at the NFL stadium, in association with BetMGM |

Best New Sportsbooks in Arizona

Arizona has seen a surge in sports betting options since online sports betting became legal in 2021. In this way, all of the legal sports betting platforms in the state are technically 'new'. Let's take a look at all of the different sportsbooks that you can visit online, in person, or both, in Arizona.

Legal Sports Betting Site | Sponsorship/Partnership | Availability |

|---|---|---|

🏈 Bally Bet Arizona | 👉 Phoenix Mercury | 🖥️ Online |

🏈 Betfred Arizona | 👉 Fort McDowell Yavapai Nation | 🖥️ Online and Retail |

🏈 BetMGM Arizona | 👉 Arizona Cardinals | 🖥️ Online and Retail |

🏈 BetRivers Arizona | 👉 Arizona Rattlers | 🖥️ Online |

🏈 Betway Arizona | 👉 Quechan Tribe | 🖥️ Online |

🏈 Caesars Arizona | 👉 Arizona Diamondbacks | 🖥️ Online and Retail |

🏈 Desert Diamond Arizona | 👉 Tohono O’odham Nation | 🖥️ Online and Retail |

🏈 DraftKings Arizona | 👉 TPC Scottsdale | 🖥️ Online and Retail |

🏈 ESPN Bet Arizona | 👉 Phoenix Speedway | 🖥️ Online |

🏈 FanDuel Arizona | 👉 Phoenix Suns | 🖥️ Online and Retail |

🏈 Golden Nugget Arizona | 👉 CHualapai Tribe | 🖥️ Online |

🏈 Hard Rock Digital Arizona | 👉 Navajo Nation | 🖥️ Online and Retail |

🏈 SaharaBets Arizona | 👉 Arizona Coyotes | 🖥️ Online |

🏈 SuperBook Arizona | 👉 Fort Mojave Indian Tribe | 🖥️ Online |

🏈 Twin Spires Arizona | 👉 Tonto Apache Tribe | 🖥️ Online and Retail |

🏈 Unibet Arizona | 👉 Quechan Tribe | 🖥️ Online and Retail |

Of course, we have our favourites. Below are some of the new Arizona sportsbooks that we think really stand out.

DraftKings: Among these sportsbooks, DraftKings stands out with their official partnership with TPC Scottsdale, home of the PGA Phoenix Open. Their top-performing apps on iOS and Android, fast payouts, and excellent performance in MLB and NBA markets make them a strong choice for sports betting enthusiasts.

Caesars Sportsbook: is another excellent option in Arizona, offering competitive promotions and a user-friendly interface. The well-known brand is known for its top-tier customer service and a comprehensive range of betting markets.

BetMGM: provides a wide variety of betting options and live betting features. They are known for offering great promotions and have a user-friendly platform. With solid mobile sports betting apps on both iOS and Android devices, BetMGM also offers a smooth betting experience for bettors on the go.

FanDuel: in partnership with the Phoenix Suns, is now licensed to offer both daily fantasy sports and event wagering in Arizona. They provide competitive odds on a vast range of sports events and have a solid suite of mobile apps, making them a strong contender for bettors in the area.

Online Sports Betting: How Does it Work in Arizona?

Sports betting is regulated in Arizona by the Arizona Department of Gaming (ADG). They are in charge of all sports betting platforms, whether land-based, online, mobile, or even fantasy sports.

If you want to place bets in Arizona then you must be over 21 years of age, be physically present in the state of Arizona, and should only bet through providers with a license from the ADG.

Below are all of the different ways that you can place bets in Arizona, with a quick explainer for each.

Online Sports Betting Sites in Arizona

Online sports betting in Arizona became legal in September 2021. Since then, notable platforms such as BetMGM, BetRivers, FanDuel, and DraftKings have entered the market. These betting sites allow you to deposit money into your account and bet online safely and legally.

Mobile Sports Betting Apps in Arizona

Many of us enjoy betting on the move and as such sports betting apps have become much more popular. These apps allow you to place wagers on the go, and enjoy features like live streaming, in-play betting, and same-game parlays.

Sports Betting Kiosks in Arizona

Arizona also offers retail sports betting options. These can be a sociable choice for those who prefer traditional, in-person betting. When choosing a retail sportsbook, it’s important to look for competitive odds, a variety of betting options, and a welcoming atmosphere for sports enthusiasts.

Fantasy Sports in Arizona

FanDuel, DraftKings, and Yahoo! are among the companies offering fantasy sports platforms in Arizona. These platforms allow you to create and manage your own virtual sports teams while engaging in various contests against other players. You can be in with the opportunity to win cash prizes based on the real-world performance of selected athletes.

Arizona Sports Betting Markets

There are lots of different options for sports betting in Arizona. Let's take a look at some of the most common types of wager below.

Moneyline

Moneyline betting is simply backing one team to win. You can place moneyline bets on all sports and they remain the simplest option for beginners.

Total

Total bets predict how many points will be scored in a game. They're particularly common in team games, such as the NBA, NFL, and NHL.

Point Spread

The point spread works kind of like a handicap, where the underdog are given an advantage over the favorite using points. For example, in an NFL game there might be a point spread of 5, meaning that the underdog could lose by a margin of 5 or fewer points and the bet would still be paid out.

Parlay Bets

Parlays are a series of 2 or more bets that must all be correct in order to be paid out. For example, you might place a bet on one team to win their football match, another team to lose their baseball game, and a player to score the final touchdown in a different football match. Only if all three things happened would you win your parlay

Same Game Parlays

These work exactly like parlay bets, except all of the bets you make happen in the same game. These are usually paid out at slightly lower odds than standard parlays.

Prop Bets

Prop bets invite you to bet on certain things happening in sporting events. It could be as simple as a player scoring a certain number of points, or even what color Gatorade is poured over the winning coach of the Super Bowl team.

Arizona's Favorite Sports

Arizona sports betting has quickly become a major player in the industry since its legalization in April 2021. Sports enthusiasts in the state have access to both online and retail sportsbooks, making it easy to wager on their favorite teams and events.

Phoenix is one of only 13 US cities to have professional teams in each of the major four sports. So naturally, these are all popular betting markets. After all, who doesn't enjoy wagering on their own team?

Let's take a look at these sports, as well as a few other Arizona favorites.

Football is undoubtedly one of the most popular sports to bet on in Arizona. The NFL and college football garner a significant amount of betting action, with fans supporting their local teams like the Arizona Cardinals and the Arizona State Sun Devils.

Basketball is another crowd-pleaser in the betting market. The Phoenix Suns have a strong following, and with FanDuel AZ partnering with them, fans can enjoy a smooth and engaging betting experience. NCAA basketball is also popular, with traditional powerhouses like the University of Arizona Wildcats.

Hockey is loved by many in Arizona, in no small part down to the killer NHL team the Coyotes. It's possible to place moneyline bets, prop bets, parlays, and futures on this sport.

Baseball is a state favorite, with the Arizona Diamondbacks being the most successful major league team in the state.

Golf Arizona is known for its warm and sunny weather, perfect for a round of golf. They hold PGA games regularly that invite betting from numerous sportsbooks.

Sport | Key Events & Teams |

|---|---|

Football | Arizona Cardinals, Arizona State Sun Devils |

Basketball | Phoenix Suns, University of Arizona Wildcats |

Hockey | Arizona Coyotes |

Baseball | Arizona Diamondbacks, Cactus League Spring Training |

Golf | Waste Management Phoenix Open |

What You Can't Bet On in Arizona

According to Arizona sports betting law there are still some things that you are not allowed to wager on. Below is a guide to events that are excluded under AZ sports betting law.

Election Betting

Recently the ADG erronously reported that election betting was legal in Arizona - it isn't. It is still not legal to bet on political events in Arizona.

College Sports

Up until September 2023 it was illegal to bet on college sports in Arizona. It's since been lifted and it's now possible to place prop bets, parlays, moneyline bets, and futures. However, you cannot place prop bets on individual players.

High School Athletics

No betting is allowed on high school athletics. This ban is still in place, so you won't find odds on high school athletics at any sportsbooks in Arizona.

Pros and Cons of Sports Betting in Arizona

With the recent legalization of sports betting, there are arguments for and against taking part. Here they are, broken down below.

✅Economic benefits: Legalizing sports betting in Arizona has generated significant revenue for the state. This income can be used to fund K-12 education, provide support to tribal nations, and improve social safety and infrastructure systems in Arizona source.

✅Regulation and oversight: With the legalization of sports betting, Arizona can now collect data, control the betting market, and introduce safeguards for responsible gaming. This helps to ensure that sports betting activities stay within the domain of licensed operators and government oversight, effectively reducing black market transactions source.

❌Addiction risk: The easy availability of sports betting can lead to an increase in gambling addiction, especially among young individuals who might not be aware of the associated risks. Addiction to gambling can negatively affect financial stability, personal relationships, and mental health.

❌Potential for match-fixing: Legal sports betting may inadvertently increase the likelihood of match-fixing as it opens up new avenues for illegal activities such as influencing the outcome of games. Professional athletes could become susceptible to bribes and manipulation for personal financial gains.

How to Start Betting in Arizona

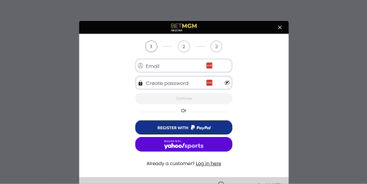

So, you've read all about it and you're ready to start placing bets? Below is a guide on how to sign up to an Arizona sportsbook. We're using BetMGM as an example.

Head to the site of your choice

First, head to the Arizona sportsbook of your choice. We'll use BetMGM for this example. Once there, click the Sign Up button to start.

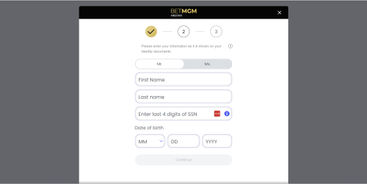

Enter your personal information

A pop up will open and ask for your personal information. It's important that you answer this truthfully as it helps the sportsbook to verify your identity. They have to do this to comply with state law.

Enter your desired login details

Next, you'll be invited to choose your login details. Remember to use a secure and unique password that nobody could guess.

Claim a welcome bonus

Before you make your first deposit, consider claiming the welcome bonus. You can find this along with any necessary promo codes on the bonus page.

How to Deposit Money at Arizona Betting Sites

Making your first deposit at any Arizona sportsbook is easy. Let's use BetMGM as an example:

Log in to your favorite sportsbook

Head to your favorite sportsbook. In this case we're using BetMGM. Once you're there, log in to your account.

Click on the cashier

Once logged in, click on the cashier. There you need to click on deposit to start the process.

Select your payment method

You'll be presented with a list of payment methods, choose the one that is the most convenient for you. Remember, some payment providers might take longer to clear funds than others.

Finalize your payment

Enter how much you'd like to deposit and complete any information requested. Your funds should reflect in your account balance instantly.

How to Withdraw Money from Arizona Betting Sites

Want to get your hands on your winnings quickly? Follow these steps to learn how to withdraw money from BetMGM.

Log in to your betting account

Head to your favorite Arizona sportsbook and log in to your betting account.

Head to the cashier

Click to head to the cashier. Once there, select that you want to make a withdrawal.

Choose your payment provider

You'll be presented with a choice of payment providers, select the one that works for you.

Await your funds

Enter the amount that you'd like to withdraw, being mindful of the minimum and maximum withdrawal limits. Submit your withdrawal request and wait for your funds to arrive.

Best Arizona Sports Betting Deposit and Withdrawal Methods

Now that you know how to make deposits and withdrawals at Arizona sportsbooks, let's look at the best providers. Each of these has its own benefits, which we'll cover below.

Debit Card (Visa / Mastercard)

Debit cards, particularly Visa and Mastercard, are among the most popular deposit methods at Arizona sportsbooks. This payment method offers instant deposits and a secure way to fund your account. However, withdrawals can take a few days to process. Many sportsbooks offer promotions when using debit cards, making it a favored choice among bettors.

Bank Transfer

Bank transfers are another common way to deposit and withdraw money at Arizona sports betting sites. This option provides a direct connection between your sportsbook account and your bank which makes transactions safe and efficient.

It typically takes 1-2 business days for deposits to clear and 2-5 days for withdrawals. Online sportsbooks like Betfred and operators at Phoenix Raceway may provide this method for bettors.

PayPal

PayPal is a popular choice for online transactions and widely accepted among Arizona sportsbooks. It allows for quick deposits and withdrawals, typically within 24 hours. PayPal is especially appealing for bettors who prefer to keep their bank and sports betting finances separate.

Some sportsbooks even offer promotions for using PayPal.

Digital Wallets (Neteller, Skrill, Trustly)

Digital wallets like Neteller, Skrill, and Trustly are also gaining popularity for sports betting deposits and withdrawals in Arizona.

These services offer an additional layer of security by acting as a middleman between your bank and the sportsbook. Deposits are usually instant, while withdrawals can take anywhere from a few hours to 2 days depending on the service.

Cryptocurrency

Cryptocurrency is becoming more widespread as a deposit and withdrawal method for sports betting in Arizona, particularly for bettors looking to maintain anonymity or avoid traditional banking systems. Some sportsbooks even offer competitive odds and promotions for bettors who use cryptocurrencies like Bitcoin, Ethereum, or Litecoin.

While deposits are typically instant, withdrawal times can vary depending on the sportsbook and the specific cryptocurrency used.

Payment Method | Time Scale | Acceptance | Bonus Eligibility |

|---|---|---|---|

Debit card | Fast - Medium | Widely accepted | High |

Bank Transfer | Slow | Widely accepted | High |

PayPal | Fast | Widely accepted | Medium - high |

Trustly | Fast | Medium acceptance | Medium |

Skrill | Fast | Medium acceptance | Low |

Neteller | Fast | Medium acceptance | Low |

Cryptocurrency | Fast - Medium | Low acceptance | Low |

Arizona Sports Betting Handle

Arizona continues to break records when it comes to its sports betting handle. In November 2023, the total handle was $713,586,703, knocking off the previous state handle record of $690,979,294 in March 2022.

In terms of the operators making the most money, here are the stats for November 2023:

DraftKings and partner Crown Gaming led the pack. Online revenue from the duo reached $9.7m from $229.4m in wagers.

FanDuel was second in terms of profit at $7.7m. Though it actually took more bets, processing a total of $249.3m in online bets.

Bally Interactive came third. It made $1.9m from $91.7m in online wagers.

What does this mean for Arizona though? Well, it means money is being kept in state. The taxes from these profits can be reinvested, creating a better quality of living for everyone. Plus, these wagers are being kept out of the hands of illegal sportsbooks.

The Transition from Black Market to Faster, Safer and Legal Sportsbooks

According to estimates by the American Gaming Association (AMA), the size of the illegal sports gambling market in the US was around $150 billion annually. Wagering was done mainly over offshore sites or through illegal ‘barroom’ or ‘corner’ bookies, with betting options limited mostly to pre-game predictions if a team would win or lose a match. Customer protection and even confidence that winnings will be actually received were virtually non-existent.

Currently, more than two-thirds of all states have already authorized sports betting and even more states are considering doing so. Even though illegal wagering has not been wiped out yet, with more states following the legalization trend, regulated betting will keep growing at the expense of the black market.

“Americans have never been more interested in legal sports wagering,” states AMA CEO Bill Miller. “The growth of legal options across the country not only protects fans and the integrity of games and bets, but also puts illegal operators on notice that their time is limited.”

Recent Legal Updates to Sports Betting in Arizona

In recent years, Arizona has witnessed significant changes in its sports betting landscape. One notable update occurred in 2021 when Governor Doug Ducey signed HB 2772 into law, legalizing both online and retail sports wagering within the state.

This new legislation allowed sports betting operators to partner with professional teams and venues. For instance, the Arizona Diamondbacks’ home field, Chase Field, has chosen Caesars Sportsbook as its sports betting partner. Similarly, the NHL’s Arizona Coyotes have teamed up with Unibet.

Here’s a summary of some key sports betting partnerships in Arizona:

Team/Venue | Sportsbook Partner |

|---|---|

Chase Field | |

Arizona Coyotes | |

TPC Scottsdale | |

Phoenix Suns |

With the introduction of these legal updates, sports betting enthusiasts can now conveniently place bets at various locations across the state or through online platforms. As a result, Arizona is quickly becoming an attractive destination for sports bettors, with numerous sportsbooks offering competitive odds, promotions, and incentives.

Tips for Choosing the Best Sportsbook in Arizona

When looking for the best sportsbook in Arizona, there are a few key factors to consider that will help ensure a positive betting experience. Let’s explore some of these factors.

Reputation and trustworthiness are essential when selecting an Arizona sportsbook. Stick to well-established brands like DraftKings Sportsbook and FanDuel Sportsbook that have a strong presence in the industry and are known for their reliability.

Competitive odds and pricing are crucial for maximizing profits. It’s a good idea to compare the odds offered by various sportsbooks on the same event. Look for a sportsbook that consistently provides favorable odds and offers features like same-game parlays, such as the ones offered by BetMGM.

User-friendly interface and platform should be easy to navigate. A smooth, user-friendly experience makes placing bets more enjoyable and less cumbersome. Mobile sports betting apps are also important for on-the-go betting.

Wide range of sports and betting markets is essential for catering to your interests. The best sportsbooks in Arizona will offer a diverse selection of sports, from mainstream events like the NFL and NBA to more niche markets like darts and e-sports.

Bonuses and promotions can give you extra value when placing your bets. Look for sportsbooks offering promotions like sign-up bonuses, free bets, and boosted odds. For example, some Arizona sportsbooks offer a no sweat first bet of up to $1,000.

Customer support should be accessible and responsive. If you encounter any issues while betting, it’s crucial to have a responsive customer support team available to assist you.

Best Sports Betting Strategies for Arizona Bettors

In Arizona, sports betting has become increasingly popular, with numerous options available for fans to wager. Whether you’re a seasoned bettor or just starting, it’s essential to have sound strategies in place to maximize your chances of success.

Strategy | How it works |

|---|---|

Line/Odds Shopping | Before you place a bet, compare the odds and lines that are available elsewhere. You don't have to stay loyal to one sportsbook if there's another offering better odds. |

Middling Your Bets | Middling your bets involves placing bets on opposing outcomes in the same game. To do this you need to watch line movements so you have a chance to win both bets. |

Become a Specialist | Focusing on a specific sport and betting market allows you to become an expert and gain in-depth knowledge. This expertise will increase your chances of placing successful bets. |

Manage Your Bankroll | Establish a budget for your sports betting activities, and stick to it. This will help you avoid significant losses and ensure a more enjoyable betting experience. |

Benefit From Bonuses | Bonuses can be lucrative, if you know how to spot the good ones. Look for bonuses with low wagering requirements, high win caps and flexibility on odds. You can use these to your advantage. |

Other Ways to Legally Gamble in Arizona

Sports betting is probably always going to be the most popular betting option in Arizona. However, there are other choices! Let's take a look at them below.

Daily Fantasy Sports

One popular option is daily fantasy sports (DFS), which became legal in Arizona in September 2021. DFS allows fans to participate in unique contests based on the statistical performances of real-life athletes during a specific time period, such as a day or a week.

Tribal Casinos

In addition to sports betting and DFS, Arizona is home to numerous tribal casinos that offer a wide range of gambling opportunities like slot machines, table games, and poker. Some of the popular casinos include Casino Arizona, Talking Stick Resort, and Desert Diamond Casino.

Off Track Betting

One lesser-known form of gambling in Arizona is horse racing and off-track betting (OTB). Horse racing has a long-standing history in the state, and Arizonans can enjoy live racing action at tracks like Turf Paradise in Phoenix and Rillito Park in Tucson. Off-track betting facilities allow enthusiasts to place wagers on horse races happening at other locations throughout the country.

Arizona Lottery

For those who prefer lottery-style gaming, the Arizona Lottery offers a selection of draw games, scratch-off tickets, and specialty games. Established in 1981, the Arizona Lottery has provided players with fun and exciting options, while generating funds for various state programs and initiatives. Lottery games can be purchased at retail locations throughout the state, giving everyone a chance to win big.

Should I Bet on Offshore and Gray Market Sportsbooks?

Offshore and gray market sportsbooks are often tempting options for bettors due to their wide variety of betting lines and wager types. However, since sports betting became legal in Arizona in 2021, you should consider the advantages and disadvantages of both options before placing bets.

✅Wider Wager Types: Offshore sportsbooks sometimes offer a broader range of betting options than state-regulated sportsbooks. This can include niche markets like politics, entertainment, and props.

✅Potentially Higher Betting Limits: Some offshore sportsbooks may offer higher limits than state-regulated sportsbooks, which can be an advantage for seasoned bettors.

❌Legal Concerns: Since Arizona has legalized sports betting, it is recommended that bettors stick to state-regulated sportsbooks to avoid any potential legal issues that may arise from betting on offshore sites.

❌Lack of Consumer Protection: Offshore sportsbooks are not subject to the same regulations and consumer protection laws as Arizona sportsbooks, which may result in payment delays, disputes, or other issues.

❌Money Out of State: Betting within Arizona means that even if you lose, you win (sort of). Gambling companies make profits when you lose and they pay taxes on those profits. These are reinvested into the state.

Do You Need to Pay Tax on Sports Betting Winnings in Arizona?

In short, yes. In Arizona, sports betting winnings are considered taxable income, which means you need to report them on your state and federal income tax returns. The taxation system is progressive, so the more you win, the higher the percentage of tax you’ll be required to pay.

According to the IRS, if you receive a Form 1099, you must report your net profits on both your federal and state income tax returns. Even if you don’t receive a Form 1099, you’re still required to report your winnings. However, the amount of federal tax you owe depends on the total winnings, as you only pay federal tax on winnings over $600.

One way to offset your tax liability is by reporting your gambling losses as an itemized deduction on your federal income tax return. To do this, you need to keep accurate records of your gambling activities, including the date, type of wager, location, and amount won or lost. Losses can only be deducted up to the amount of your total winnings for the year.

Here Are Some Additional Tips for Arizona Sports Bettors:

Winnings from all sources, including casinos, lottery, racetracks, and online platforms, need to be reported.

If taxes are withheld from your winnings, make sure to consult with a tax professional to ensure you’re claiming the correct deductions.

Save copies of all gambling-related documents, such as W-2G forms, wagering tickets, and receipts from casinos or online betting platforms.

Responsible Gambling in Arizona and Where to Seek Help

In Arizona, various resources and programs are available to support responsible gambling and provide assistance to those struggling with problem gambling. Below are a handful of options specific to those betting in Arizona. After that, you'll find resources that bettors from anywhere in the USA can access.

The Arizona Department of Gaming offers educational resources and ongoing trainings for counselors working with problem gamblers and their families. These trainings cover current developments, skills, and treatment modalities, enabling counselors to provide the necessary support for individuals in need.

The state also encourages gambling operators to promote responsible gambling habits. These practices may include setting limits on wagers, offering self-exclusion options, and providing clear communication about the risks associated with gambling.

The National Council on Problem Gambling and the National Problem Gambling Helpline offer a variety of helpful resources, including a helpline (1-800-522-4700) and a chat service for those in need of assistance.